The Human Risk Hidden in Every Deal

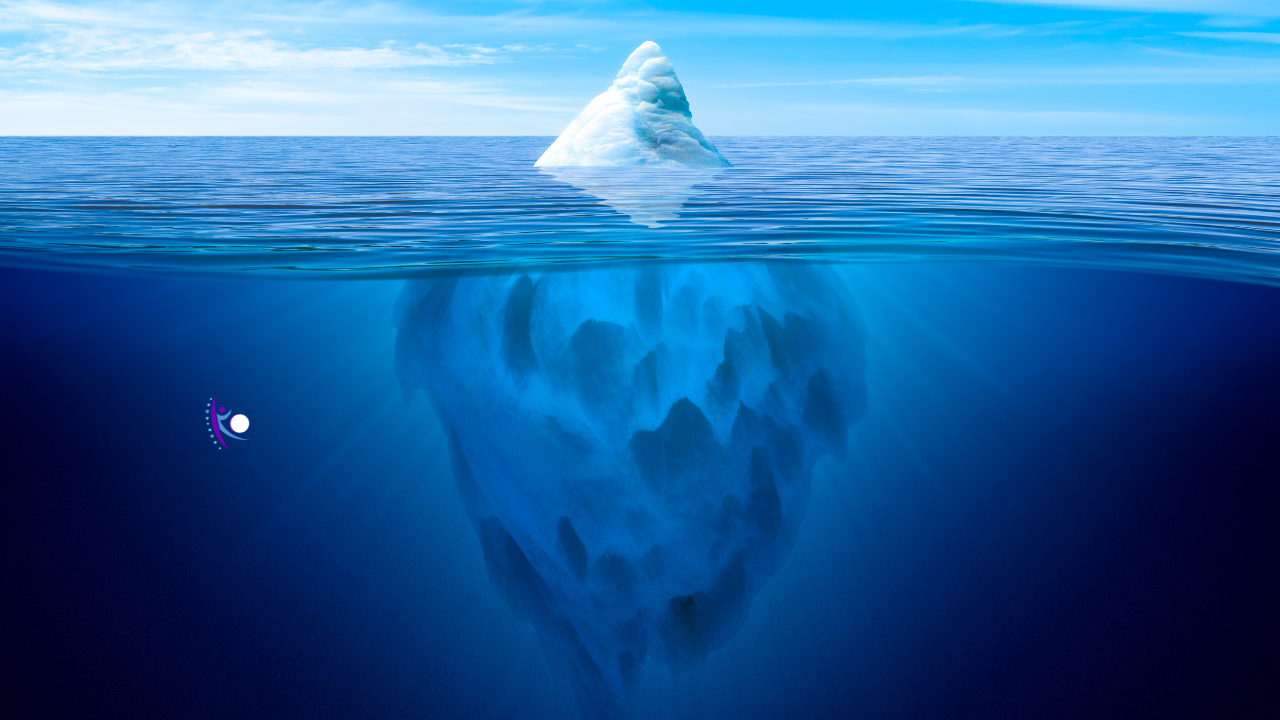

What Your Due Diligence Misses

Mergers and acquisitions look clean on paper.

The revenue is solid.

Margins look healthy.

Debt is manageable.

The EBITDA multiple makes sense.

The forecast model is optimistic.

The deal closes.

Then six months later:

A key executive leaves.

Middle management stalls.

The founder becomes unpredictable.

Productivity dips.

Revenue projections soften.

Everyone is confused.

The numbers were right.

But the numbers were never the full story.

There was a crack in the foundation.

And it wasn’t financial.

It was human instability under pressure.

This is the part most acquirers don’t formally assess.

And it is where millions are gained or lost.

Traditional Due Diligence Is Incomplete

Financial diligence is rigorous.

It should be.

You examine:

Revenue concentration

Legal exposure

Debt structure

Market conditions

Historical performance

You model risk.

You scenario plan.

You stress-test assumptions.

But almost no one evaluates:

Power distortion

Identity fragility in leadership

Executive containment capacity

Cultural permission structures

Narrative coherence

These are not “soft” issues.

They are structural.

And when left unseen, they fracture performance.

I don’t observe entitlement.

I observe systemic stability under pressure.

Entitlement is just loud.

What I Actually See Inside Organizations

When I enter a workplace — especially one in transition — I am not looking at perks, programs, or morale.

I am scanning for human pattern stability.

Here’s what that means.

1️⃣ Power Distortion

In almost every founder-led organization, power is misaligned.

On the org chart, authority looks clear.

In reality?

Someone else holds it.

Or no one does.

Sometimes the founder still makes every real decision but pretends to delegate.

Sometimes middle managers perform authority but have no backing.

Sometimes executives avoid power entirely to keep peace.

Here’s what this looks like in a deal:

Integration decisions stall.

Accountability dissolves.

People wait instead of act.

Blame increases.

On paper, the leadership team looks intact.

Under pressure, authority collapses.

That is integration risk.

And it is rarely identified pre-deal.

2️⃣ Identity Fragility in Leadership

This is one of the most expensive blind spots in M&A.

Founders often overidentify with their title.

Their identity is fused with the company.

When ownership shifts, even partially, something destabilizes internally.

You can see it instantly:

They become defensive during oversight.

Feedback feels like threat.

They oscillate between compliance and control.

They seek validation from employees to regain footing.

To an acquirer, this shows up as “resistance.”

But resistance is not the root.

Identity fragility is.

If a leader cannot separate self-worth from authority, transition becomes volatile.

This is not psychology theory.

It is operational risk.

3️⃣ Containment Capacity

This is the lens that separates seasoned executives from destabilizing ones.

Can this leader:

Sit in ambiguity without creating panic?

Absorb projection without reacting?

Hold emotional volatility without amplifying it?

Handle a 3 a.m. operational issue without spiraling? (read the article about the 3 a.m. panic call every M&A client has had and what to do about it)

I call this executive nervous system range.

Some leaders regulate pressure.

Others transmit it.

When pressure is transmitted downward, culture destabilizes.

Meetings tighten.

Communication narrows.

Decision-making shrinks.

Productivity quietly erodes.

You will not see this on a spreadsheet.

But you will feel it in margin performance six months later.

4️⃣ Cultural Permission Structures

Every organization has invisible rules.

What is safe to say?

What gets punished?

What is tolerated but never addressed?

In acquisitions, this becomes critical.

If speaking honestly was unsafe before the deal, it becomes more unsafe after.

If entitlement was tolerated quietly, it expands under ambiguity.

If accountability was inconsistent, it collapses entirely during integration.

I read the permission system quickly.

Because that system predicts whether change will take root — or quietly fail.

Read about the real root of toxic workplace culture

5️⃣ Entropy Points

Every company leaks energy somewhere.

It might be:

Middle management confusion

Founder micromanagement

Executive misalignment

Cross-functional distrust

Energy leakage equals margin leakage.

When integration pressure increases, these leaks widen.

The deal doesn’t fail loudly.

It drifts.

And drift is expensive.

6️⃣ Pre-Deal and Post-Deal Fragility

Acquisitions amplify what is already unstable.

Pre-deal, you often see:

Founder attachment to identity

Buyer overconfidence

Cultural mismatch risk

Silent resistance pockets

Executive shadow conflicts

These don’t explode immediately.

They surface slowly.

Then one key person leaves.

Then two.

Then momentum breaks.

The numbers were correct.

The human system wasn’t.

7️⃣ Narrative Drift

This is advanced, but powerful.

What story does leadership believe about themselves?

“Collaborative.”

“High-performing.”

“Aligned.”

Now ask employees privately.

Does their story match?

When leadership narrative and employee narrative diverge, instability grows.

If leaders believe they are transparent but employees feel guarded, trust erodes.

If executives believe they empower autonomy but managers feel controlled, resentment builds.

Narrative incoherence predicts performance volatility.

Almost no diligence process assesses this.

Why Entitlement Is a Surface Symptom

Entitlement is visible.

It’s dramatic.

It’s easy to call out.

But it’s rarely the root.

Most entitlement is downstream of:

Power distortion

Poor containment modeling

Leadership insecurity

Inconsistent consequences

Cultural drift

Founder guilt

When you diagnose upstream, entitlement resolves structurally.

When you attack entitlement directly, it mutates.

This is why most “culture fixes” fail.

They treat symptoms.

Not structure.

The Financial Impact

Unseen human instability leads to:

Executive turnover

Culture shock

Productivity loss

Delayed integration

Revenue dips

Margin erosion

This is not soft.

This is predictive.

If you can see where leadership destabilizes culture under pressure, you can stabilize it before it fractures performance.

That is leverage.

What This Looks Like in a Deal Environment

In M&A, this work becomes:

Pre-deal human risk scanning

Executive containment assessment

Cultural pressure mapping

Integration stability advisory

Shadow observation during transition

Not therapy.

Not morale programs.

Structural human risk intelligence.

Most acquirers evaluate financial exposure.

Very few evaluate nervous system exposure.

But leadership instability under pressure is often the most expensive risk in the room.

Where I Shine

I shine in mergers and acquisitions because transition forces truth.

Pressure reveals instability.

Ambiguity exposes power distortion.

Identity fragility becomes visible.

Containment capacity is tested.

In steady-state companies, these patterns can hide.

In deals, they surface.

And if you can see them early, you can stabilize them early.

That saves millions.

Or generates more.

Because when leadership is structurally stable under pressure, integration accelerates.

Momentum compounds.

Revenue grows instead of dips.

I observe what others miss inside leadership.

And I stabilize it before it costs you.

M&A deals miss hidden human risks. Power distortion, identity fragility, and containment capacity predict integration success. Unseen leadership instability drives turnover, delays, and margin erosion. Stabilize early to protect value. #MergersAndAcquisitions #Leadership #DueDiligence #ExecutiveStrategy #IntegrationRisk