Human Risk in M&A

The Fractures Before the Deal

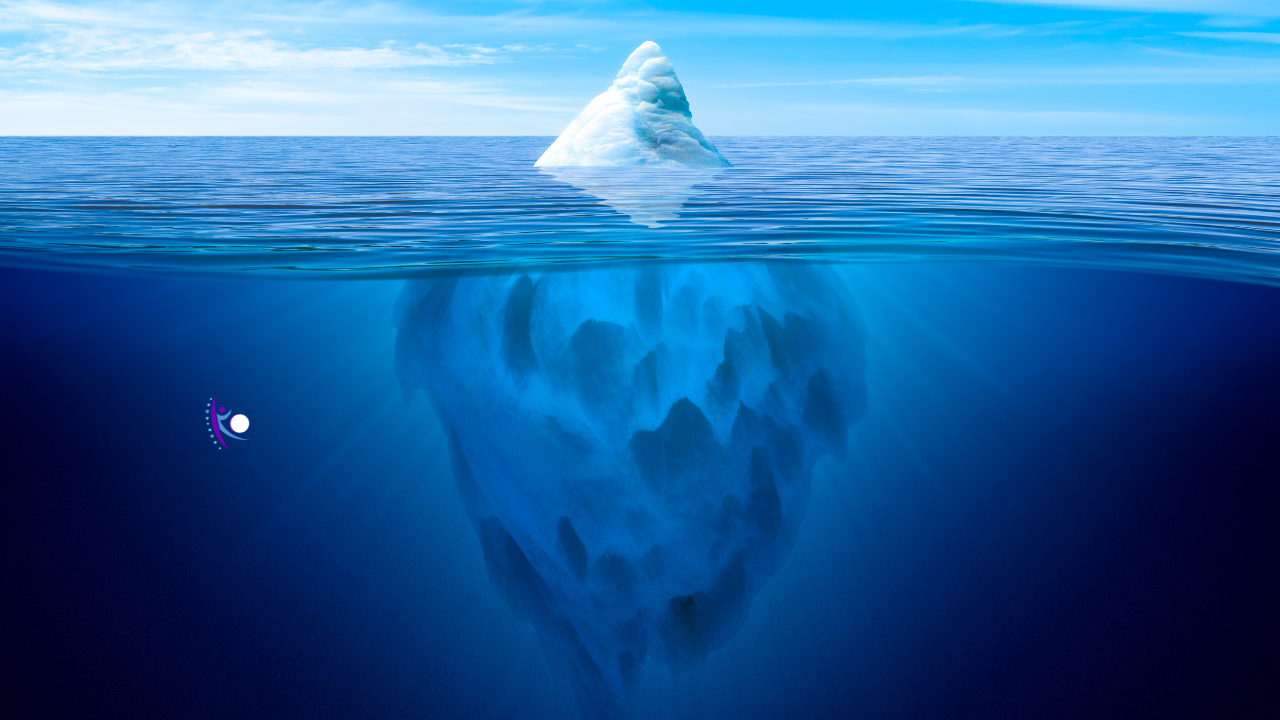

There is a moment in every acquisition that feels clean.

The numbers are solid.

The legal files are tidy.

The model works.

The deal makes sense.

On paper.

But paper doesn’t acquire companies.

People do.

And people carry fractures long before a deal closes.

Most post-acquisition failures are not created by the deal.

They are revealed by it.

That is the part we rarely name.

The Illusion of Clean Financials

I have sat in rooms where EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) strong.

Revenue was growing.

Margins were steady.

Everyone felt confident.

But beneath that confidence, there was tension.

A founder who had not taken a real vacation in seven years.

A COO quietly absorbing political conflict.

A leadership team performing unity while avoiding hard conversations.

The financials were clean.

The human system was not.

Financial diligence asks:

Are the numbers real?

Human risk intelligence asks:

Are the relationships stable enough to survive change?

That is a different question.

And it changes everything.

The Founder Identity Trap

Most founders say they are ready to sell.

Financially, they may be.

Psychologically, many are not.

When identity and company are fused, the transaction becomes destabilizing.

You are not just selling assets.

You are altering identity.

If the founder has been the central stabilizer, the cultural glue, the decision bottleneck, and the emotional regulator of the company — removing them shifts gravity.

If they stay post-acquisition, attachment shows up in subtle ways:

Resistance to new systems

Undermining integration quietly

Emotional volatility masked as “standards”

Inability to release control

If they leave abruptly, you may see:

Talent loyalty fractures

Cultural drift

Identity confusion

These patterns are rarely measured before closing.

But they are predictable.

The fracture already exists.

The acquisition simply amplifies it.

The Leadership Regulation Gap

Deals introduce pressure.

Pressure reveals regulation capacity.

When executive teams are not emotionally regulated under stress, you will see it quickly post-close:

Decision paralysis

Political triangulation

Increased oversight

Defensive communication

Talent withdrawal

This is not about personality.

It is about nervous system stability under pressure.

Acquirers evaluate strategic alignment.

They evaluate synergy potential.

Rarely do they evaluate:

How does this leadership team metabolize conflict?

Can they hold uncertainty without destabilizing the organization?

If the leadership team relies on avoidance, suppression, or control to manage stress, integration will magnify those patterns.

Integration does not create dysregulation.

It exposes it.

Silent Loyalty Networks

Org charts tell one story.

Loyalty tells another.

In founder-led organizations, there are often invisible loyalty webs:

Early employees who are loyal to the founder, not the mission

Senior leaders who derive identity from proximity

Teams bonded through shared struggle

Informal influencers who stabilize morale

When control shifts, those loyalties shift too.

Or fracture.

If this is not mapped pre-deal, the first 12 months post-close often include:

Quiet disengagement

Resignations that appear “unexpected”

Political alliances forming beneath the surface

Cultural confusion

None of this is irrational.

It is human.

But if it is not anticipated, enterprise value erodes silently.

By the time it becomes visible, it is already expensive.

Identity Transition Readiness

Acquisition is identity disruption.

For founders.

For executives.

For long-term employees.

The question is not whether change will occur.

The question is whether the organization can metabolize it.

Some companies are structurally dependent on one personality.

Some cultures operate through implicit understandings that are never documented.

Some leadership teams have never been challenged at scale.

When new governance arrives, those hidden dependencies surface.

This is not a culture problem.

It is a transition readiness problem.

And readiness can be observed.

Before the deal.

Why Post-Deal Repair Costs More

Post-deal support is budgeted as expense.

Human fracture detection is positioned as risk mitigation.

Those are not the same category.

Repair includes:

Executive coaching under pressure

Retention bonuses to prevent talent flight

Culture initiatives after morale drops

Reorganization due to political misalignment

Mitigation includes:

Seeing attachment before it destabilizes

Mapping loyalty before it fractures

Evaluating regulation before pressure spikes

Assessing identity readiness before authority shifts

One preserves value.

The other attempts to restore it.

And restoration is always more expensive.

The Gap the Industry Has Not Fully Named

M&A professionals conduct:

Financial due diligence

Legal due diligence

Operational diligence

Very few conduct:

Emotional load analysis

Founder attachment assessment

Leadership regulation screening

Identity transition readiness evaluation

Hidden loyalty mapping

These variables are not abstract.

They are measurable through observation.

You can see:

Where overextension is occurring

Where authority is fused to personality

Where conflict is suppressed

Where regulation fails under pressure

Where identity fragility hides beneath performance

These fractures do not begin post-close.

They are present before valuation multiples are calculated.

Before integration plans are drafted.

Before key talent quietly disengages.

The acquisition does not create the fracture.

It amplifies what was already there.

Executive Positioning

This is not culture consulting.

It is not integration support.

It is pre-deal human risk intelligence.

For acquirers who understand that enterprise value is not only financial.

It is relational.

It is regulatory.

It is identity-based.

The most sophisticated operators already sense this.

They feel something intangible during diligence conversations.

They cannot yet quantify it.

But they know it matters.

This work gives language to that intuition.

And clarity protects value.

The Closing Reality

By the time culture becomes visibly unstable, enterprise value has already been compromised.

By the time talent leaves, trust has already eroded.

By the time integration slows, friction has already compounded.

The fractures were visible.

If you knew where to look.

The question is not whether human risk exists in a deal.

It always does.

The question is whether you are looking for it early enough to preserve value.

About Kathie Owen

Kathie Owen is a private consultant who works with founders, acquirers, and executive teams operating in complex, high-stakes environments. Her work centers on observing and stabilizing the human patterns that shape leadership beneath strategy, titles, and systems.

She provides pre and post-deal human risk intelligence and executive advisory support for operators who understand that performance is ultimately human.

Most M&A failures are visible before closing. Financial diligence misses human risk—founder attachment, leadership regulation gaps, and loyalty networks that erode value. Pre-deal intelligence protects enterprise value. #MergersAndAcquisitions #PrivateEquity #HumanRisk #Leadership #DueDiligence